Effects of the Nile on Ancient Egyptian Agriculture by Amber Banks

Located in Africa, situated in-between two major deserts lay Egypt. A country whose history shows evidence of a remarkable group of people who were able to maintain its economy, religion, government, and ecological techniques longer than any other ancient civilization (Hughes, pp12). Over the years archaeologists have uncovered artifacts such as tools, musical instruments, and pottery that suggest a culturally sophisticated society. The questions arises however, how was this possible in a place where temperatures were almost always above 85 degrees and where very little rain fell? What kind of food was available to them in order for them to survive and create those spectacular pyramids that still stand to this day? The answer has a lot to do with the Nile River, whose predictable, and almost always reliable flooding allowed the ancient Egyptians to evolve from hunter-gatherers to farmers.

Prior to farming, ancient Egyptians depended on foraging tactics. They stayed close to the Nile River in order to find food to feed themselves and their families. One of the most common food sources was catfish, which was widely available when the river flooded, and also when it receded in autumn (Allen pp. 139). However, this type of living was later replaced when the Egyptians began to utilize the annual flooding of the Nile River to harvest other crops such as wheat, barley, and flax . Converting to this type of living was beneficial for the Egyptians because they were able to produce a more reliable food source, rather than searching for food day by day.

The shift from foraging to farming freed up a lot of the Egyptian’s time because instead of having to go out and catch fish everyday, they were able to grow more storable crops that would last longer throughout the year. According to Allen Robert, “Agriculture changed the seasonal pattern of labor and generated a labor surplus that could be mobilized for work away from the farm.” This meant that during the non-harvesting season, farmers were able to provide labor to other tasks like pyramid building.

Agriculture also had an effect on trade within the Egyptian society. Flax, for example, was used to make linens and papyrus root was used to produce paper. Archeological records show that trade between Egypt and Sudan as far back as 4000 B.C. Between the two countries items such as cloth, elegant pieces of pottery, and weapons were traded for items such as gold, ostrich feathers, and animal skins. Being able to trade goods with other countries may have also had an impact on the social stratification that would eventually occur within the country.

The result of becoming an agrarian society effected many aspects of ancient Egyptian civilization. It allowed the Egyptians to produce more storable goods that could last longer than the food sources they relied on as foragers. It created a seasonal labor work system, where each season was designated to planting and plowing, harvesting, or non-agrarian work such as pyramid building. It also allowed for trade with other countries for goods that were not readily available within Egypt.

Taxes in the Middle Kingdom

The economy of the Middle Kingdom was far different from that of the Old Kingdom. The Old Kingdom had a centralized government who had complete control of it inhabitants. However after many years, its government lost control and unfortunately never regained its strength in its entirety. Most Egyptologists characterize the Middle Kingdom’s government as being weaker and more decentralized than that of the Old Kingdom (Ezzamel 65). However, during this time we begin to see more structure building, increase in trade, which leads us to wonder how did the economy survive without a strong centralized government as before? The answer has a lot to do with the accounting practices that were established by the pharaohs of the Middle Kingdom.

One of the main problems that occurred at the end of the Old Kingdom and throughout the intermediate period was the government’s inability to collect taxes from the people of Egypt. However, by the Middle Kingdom, it’s government had “created a more systematic and detailed bookkeeping” strategy for collecting taxes. Scribes measured and recorded crop measurements and then calculated and collected tax liability from farmers. They also collected taxes on game in a similar way. If subjects were self-employed, then they paid direct taxes to the government.

Once taxes were collected they were transferred to it’s appropriate storage destination. Most grain taxes were stored in religious institutions such as temples. These temples were very important to the redistribution by the government. Not only did they collect and store revenue, but they also “produced a surplus of income” from it’s own labor who rented land at a rate of 30% of the crop (Ezzmel 70).The revenue that was made from these temples was spent on building and restoration projects, upkeep of the temple priests and offerings for daily rituals and much more. The temples also served as a trading source when they needed other commodities not readily available to them.

Of course, just like today, there were those who were unable to pay taxes. Unfortunately for them there was a system of forced labor put in place that mostly included men and women of the middle and lower class. These men and women were enlisted to undertake physical tasks, including military service (Shaw 161). If you had enough goods to “pay” someone else to do the work for you, you could avoid the work, but if you avoided it altogether you were punished severely for it.

Taxes were vital to the success of the pharaoh and it’s government because it was it it’s only source of income. At this time in ancient Egyptian history, monetary currency was nonexistent. Which means people weren’t paid in money like we are today, but were paid with crops or goods or game. The pharaoh and its government used the storing facilities (temples) as a means to provide for the needs of the palace and its dependents. Also it was used to provide provisions for the priests, temple workers and workmen engaged in the state projects. Lastly the storage facilities were used to supple a minimum sustenance for the population especially in times of shortages. (Ezzamel 63). Very much like today, taxes were collected and used for the government’s personal use. Some scholars believe that the collecting and redistribution is done by the king fir specific royal purposes rather than as part of the wider distributive

system (Bleiberg 156).

Ma'at

In ancient Egypt, crime existed. There were thieves, people were bribed, and in turn people were punished. However, there is very little evidence that shows a written law that was used by the Egyptians. According to crystalinks, the Egyptians used a system that was more based on common sense. The legal system wasn’t as sophisticated as ours is today but there seems to have been some kind of system in place. The ancient Egyptians focused more on the concept of Ma’at. Ma’at was a concept in ancient Egypt that referred to the idea of truth, balance, and law and order. Ma’at was also personified into a goddess who was believed to be the daughter of Ra.

In his book, Law in Ancient Egypt ,Versteeg states that the head of the legal system was the pharaoh and he was expected to uphold the concept of Ma’at. Small claims were ususally presented to a council of elders, but more serious cases such as tomb robbery and murder were presented in front of the pharaoh. Punishment for these cases usually resulted in execution whereas for small theft , items were returned or paid for.

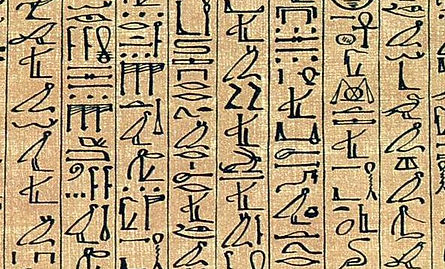

Much of what Egyptologists know about justice and the law in ancient Egypt comes from papyri that has survived.